ESM5/SPX 21/4/25 PLAN - Balanced Zones = Strong Moves Once Broken

Volumes Dried Up & We Are In Balance, Here's Some Plans To Prepare For When We Break Balance.

Hey guys 👋

I know it’s been quiet from me this week — I haven’t posted much, and honestly, that’s just a reflection of the market itself. The price action and volume we’ve seen recently has been really low quality 🔍… and that’s not something I look to trade aggressively.

This week was super light for me — just two trades on Monday and Tuesday, and one on Thursday. That’s it. Nothing crazy, no fireworks 🎆. Just sitting on hands and waiting for proper setups to show themselves.

Now let’s talk about the session ahead for 21/4/25 — and more importantly, the levels I’m watching 👀

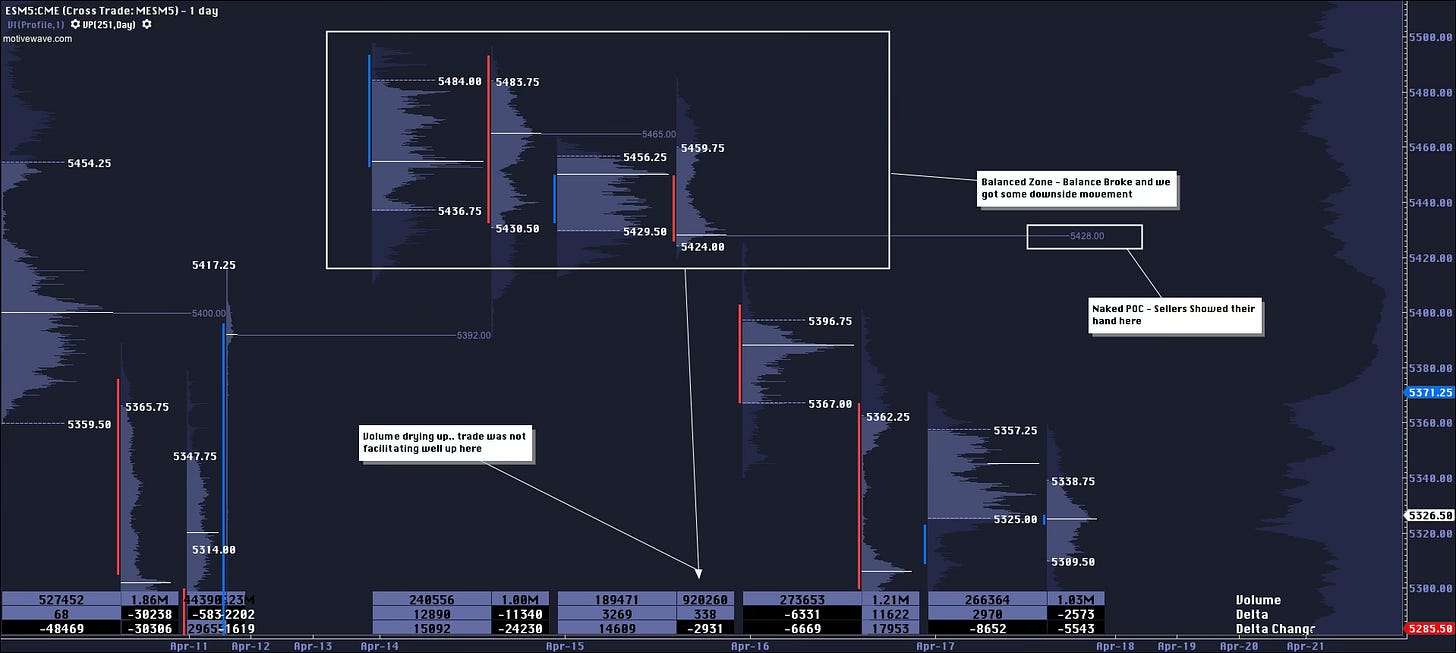

We wrapped up Thursday sitting in a very balanced zone, which left behind a D-shaped profile — this tells us that the market was in agreement about value at those levels. Often when we see this, we’re either gearing up for a breakout or a continuation of balance… the key is to be reactive, not predictive.

🚀 Bullish Scenario:

I’m bullish above 5340, where I’ll be targeting those poor highs left behind at 5371.25. We could look to take partials there, or hold for a full move — that’s a clean 30-point target if it plays out. Your choice whether to scale out or take the full ride 🎯. Keep your eyes on how price reacts into those poor highs — they may act as resistance, but if taken out with strength, it tells us buyers are still in control 💪

📉 Bearish Scenario:

If we break down below 5310, I’ll be looking for price to move toward the buying tail at 5285.50, which makes for a nice TP zone. That level acted as strong support before, so it’ll be crucial to see how buyers show up (or don’t) down there. If that tail doesn’t hold, then things could get really interesting...

Now zooming out a bit… remember what I mentioned last week — I didn’t think this upward movement had much more fuel left in the tank ⛽️. The market hasn't been facilitating trade well in the 5400s, and that showed clearly on Wednesday when they moved price lower.

👀 I’m still leaning toward further downside from here. There’s just not a lot of volume supporting higher prices right now. If buyers want to keep control, they must defend levels like 5087.25, where we’ve got some single prints — that’s a key sign of bullish strength (or weakness, if it fails). If that breaks… things could unwind fast.

Also keep in mind, we’ve still got poor lows at 4980 lingering — those might need to be cleaned up at some point 🧹. Price tends to revisit those inefficiencies eventually.

As for macro sentiment — it’s still shaky. Trump’s taken the foot off the gas with the tariffs, but overall, investors are staying cautious. Fear is still in the air 😬… and that can really cap bullish momentum.

So, in short:

👉 Above 5340 = bullish bias, watch 5371.25

👉 Below 5310 = bearish bias, first TP zone 5285.50

👉 Break below 5087.25? That’s a red flag for bulls

👉 Keep 4980 in mind as a magnet if things get slippery

Not every session is a trading session. Be selective. Stay sharp. Let the market come to you. 📈📉

Catch you guys Monday,

— FH